The Myth of Living AT Your Means

Posted in Assessments & Evaluations, Dynamic Training News, Improve Sales & Profits, Latest Leadership Posts, Talent Development & Training, Team Building & Alignment on Mar 13,2018

My grandfather was a wise man. As a successful 20th century businessman he worked well into his eighties, not because he had to, but for the sheer joy of working with people and building an organization to serve his community. Among the many life lessons he taught me was the Myth of Living AT Your Means. This is his guidance:

“People either live above their means or below their means, because nobody ever lives AT their means. When someone says they are living at their means they are already living above their means with no margin for the unexpected. While their income may be sufficient to meet all their bills at present, they are one illness, one layoff, one accident, or one bad economy away from having no income and no margin.”

You’re probably saying, “Oh, that can’t happen to me…I’m in great health and have a good job with a strong employer.” That’s what I thought back in 1984.

Lesson Learned the Hard Way

I had been promoted into a high-paying job in the computer field, a job which required my relocation with family to upstate New York. It represented a 20% increase in income based on the last three years’ results of the territory I was to manage. Little did I know that I would soon test my grandfather’s wisdom. I put my Pennsylvania house up for sale and bought a nice place north of Albany. My current income would be sufficient to cover both mortgages for the period of time I expected it to take for my house in Pennsylvania to sell. My wife was expecting our first child, so it was up to my income to carry us through.

Then the market fell apart in the microcomputer industry and my annual income dropped to a mere $19,000. The mortgages on both homes ran nearly $2,300 per month. You figure the math. We were underwater big time. To make matters worse, our Pennsylvania house was not selling (it took us about a year to sell it at no gain).

I learned then that my grandfather was right. At age 29 I fell victim to the Myth of Living AT Your Means. We exhausted all our savings and met our bills – barely. I remember thinking, Lord, let not this lesson be wasted! I don’t want to ever repeat it again. And I swore to live by my grandfather’s advice, which I’ve done since 1985. I chose to live below my means.

The Current Savings Crisis

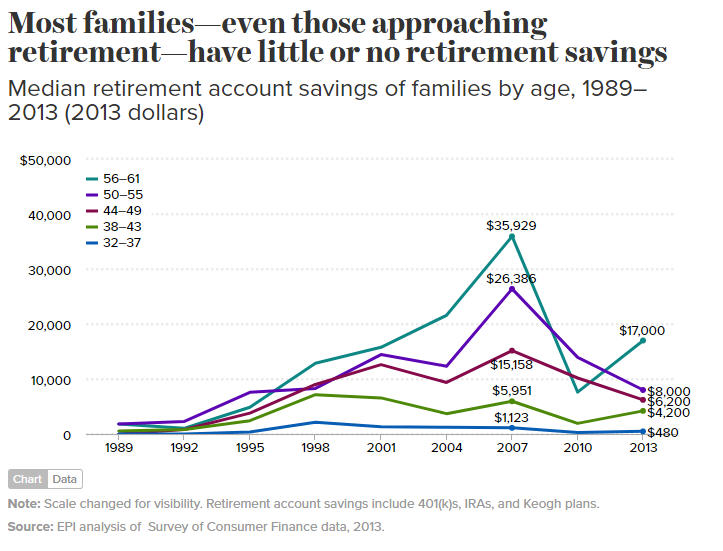

The BIG QUESTION: where are you today – do you live at, above, or below your means? If you’re like most people, you are not living below your means, if this data from the Economics Policy Institute is correct. It shows the median retirement savings by age group. Median means someone living at the middle point, in this case, at the 50th percentile (half of all people above them, and half below them). After a decade of work, those people at ages 32-37 had a little less than $500 saved up for their retirement. Those 50-55 had saved $8,000.

You and I both know that social security won’t be enough to cover needs, let alone retiring in style. The sad truth is that many of you reading this article will have to work well into your eighties just to have a roof over your head and food on the table. Unless you get disciplined about beating the Myth of Living AT Your Means…which you CAN do.

Five Rules to Live Below Your Means (and Enjoy It)

I’ve managed to live a comfortable life for more than 30 years, living below my means. My wife didn’t return to work until she was in her late forties, and we put two kids through college, paid off a mortgage, and managed to build a retirement not dependant on Social Security. Along the way we dealt with more than our share of hardships common to all. Here’s how we did it.

If your outgo is greater than your income, then your upkeep will be your downfall.

1. Get a budget and live with it. Budgeting means never spending what you don’t have. We don’t have the newest cars, latest smartphones, biggest TVs, or go on glamorous vacations to faraway places. We limit what we spend on non-necessities such as meals out, entertainment, and other pleasures.

2. Cut the cards unless you can carry a zero balance. We have a variety of credit cards. They all carry strong rewards programs but NO FEES. Their issuers don’t make any money on us because we never spend what we don’t have. We pay each month’s balance in full. If it isn’t in the budget AND in the bank, we don’t spend it. Period.

3. Refuse to be a slave to debt. We had one exception to this rule, and that was paying for a mortgage over time. For everything else, see Rule 1. Even the business I opened in 1998 was and is self-funded. No debt.

4. Priorities: pay God first, our future selves second, and everyone else third. Getting our spending priorities right was critical. Having the discipline to set aside Priorities One and Two from each pay was made easier by auto-deductions into those accounts. Systematic investment year after year has built for retirement.

5. Never pay retail. One way to stretch a budget is to never pay retail. There are oh so many sources of coupons and sharp prices for food and household items (thank you, BJ’s Warehouse), discount clothing (thank you Stein Mart), and comparison shopping for the sales. We buy what’s on sale today that we know we’ll use in the future. We have a garden that produces a goodly amount of food. Plus, let me share one little secret I learned – even retail prices are negotiable! But always follow Rule One – if you don’t have it to spend, don’t spend it.

Bottom Line

People either live above their means or below them. Nobody ever lives at his/her means. Choose to live below your means by being disciplined now in order to make a much brighter future for you and your family.

I love working with curious people! Here are several outstanding resources that can help satisfy your own curiosity in three key areas that can boost you career:

- Improving your (or your team’s) management and leadership skills: Leading Through People™

- Raising your (or your team’s) selling effectiveness: B2B Sales Essentials™

- Conducting a more effective job search: Get a Better Job Faster™

I help job seekers, higher ed, and employment services connect people to better jobs faster. My company’s acclaimed career development tools help people navigate the ever-changing landscape of conducting a successful job search. I also work with some of the world’s top employers by helping them get the most out of their talented people. My company’s extensive leadership development course catalog provides effective skills-building for everyone in the organization, from the new / developing leader to the seasoned C-level executive. My company’s coaching programs produce significant results in compressed periods of time. To find out more, please visit us at www.boyermanagement.com, email us at info@boyermanagement.com, or call us at 215-942-0982.

Latest Leadership Posts

Give Your Development Plan Transforming Power Continue Reading

The World’s Most Powerful Self-Development Tool Continue Reading

Better Ways to Manage Stress in 2026, Part 2 Continue Reading